20.06.2023 – Mindelheim

-

Strong demand and high fees ensure record revenue

-

Top 20 German consultants grow by 18.5 per cent in 2022, international consultancies by 11.5 per cent

-

Data analytics and AI changing HR structures

-

Lünendonk Survey available from July 2023

Management consultancies headquartered in Germany have increased their revenues once again: following growth of 16.6 per cent on average in 2021, the 20 largest business consultancies headquartered in Germany (the ‘Top 20’) achieved average increases of 18.5 per cent in the 2022 financial year. The leading international consulting groups also grew at a double-digit rate of 11.5 per cent. Firms are benefiting from consulting demand around business strategy, cloud, data analytics, digital engineering, ESG and crisis resilience programmes among others, as well as the ongoing boom in the wake of the Covid-19 pandemic. Revenues for 2022 are also reflective of above-average fee increases. For the current 2023 financial year, the German Top 20 expect average revenue growth of 12.2 per cent, with international consulting groups forecasting 11.7 per cent.

These are the initial findings of the new Lünendonk Survey, to be published in July 2023. Current rankings of the leading 20 German and 17 international business consultancies are available to download from www.luenendonk.de.

Market volume rises to approximately 44 billion euros

‘Against the backdrop of an already excellent 2021 financial year, 2022’s above-average growth figures are striking; the demand for consulting services in the last financial year was enormous,’ comments Lünendonk managing director Jörg Hossenfelder. ‘Looking back, the biggest challenge for the industry was staffing the commissioned projects.’ Recruitment drives led to average staffing increases of 15.5 per cent for the German Top 20, and 18.9 per cent for the international consultants.

According to industry association the Bund Deutscher Unternehmensberater (BDU), the German business consulting market grew to 43.7 billion euros in 2022 (+14.7%; 2021: €38.1 billion; 2020: €34.6 billion; 2019: €36.0 billion). Despite current geopolitical and economic challenges, market volumes in Germany are expected to increase in the 2023 financial year to 49 billion euros (+12%).

Top 20 generate 4 billion euros worldwide

The 20 leading consultancies headquartered in Germany achieved worldwide revenues of 3.92 billion euros in 2022 (previous year: 3.29 billion euros) via a total of 16,610 employees (previous year: 14,335). The German market accounted for about 60 per cent of this turnover.

Roland Berger clear leader of Top 20 ranking

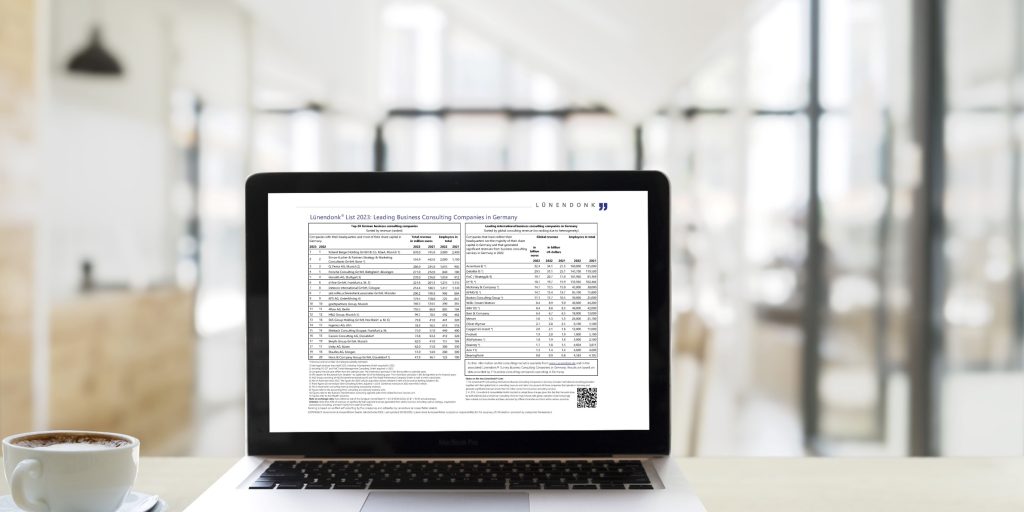

Leading the Lünendonk List of German business consultancies – and by some margin – is Roland Berger. Total revenues rose by 16.8 per cent to 870 million euros. Employee numbers (FTE) increased to 3,000. Simon-Kucher retains second place with total revenues of 534.9 million euros (+20.9%).

Rounding out the top three German management consultancies once again is Q_Perior with total revenues of 286.0 million euros (+21.7%), followed by Porsche Consulting (€271.0 million; +27.8%) and Horvath (€270.0 million; +25.0%). Sixth to eighth place are taken by consulting firms with total revenues exceeding 200 million euros each: d-fine (€221.6 million; +10.1%), Detecon (€214.4 million; +15.0 %) and zeb (€200.2 million; +4.9%).

Where 2021 saw a decline in revenue for KPS, this year witnessed a rebound for the company of 13.6% to 179.5 million euros, followed by goetzpartners (€140.5 million; +4.5%). 4flow crossed the 100-million-euro threshold (€110.5 million; +28.5%), ahead of H&Z (€99.7 million; +27.0%).

SKS and Berylls exceed growth average

With an increase in revenues of 94.6 per cent, Hochheim’s SKS saw the fastest growth among the Top 20 (€79.8 million). Having acquired b2tec Software GmbH and Innovative Banking Solutions AG in January 2022, the revenues of these firms are also included in the SKS figure. Accenture completed acquisition of the SKS Group in turn in February 2023, so from next year the latter will no longer appear in the Top 20 rankings.

Ingenics (€78.3m) and Miebach (€75.0m) both enjoyed gains of over 30 per cent and are followed by Cassini on 73.8 million euros (+16.8%). Berylls (+51.2%) and Unity (+21.6%) share seventeenth place, taking 62 million euros each. Staufen and Horn & Company close out the Top 20 generating 51.0 million euros (-5.6%) and 41.9 million euros (+14.2%) respectively.

International consulting groups also experience vigorous growth

Dominating the German consultancy market, however, is a large number of international consulting companies with diverse service offerings.

These include strategy consultants as well as M&A and HR firms and transformation consultancies. Accenture and Deloitte’s consulting units lead the market, generating more than 30 billion US dollars each, followed by PricewaterhouseCoopers (US$21 billion). International strategy consultancies BCG (US$12 billion) and Bain (US$7 billion) also gained ground in 2022, especially in Germany. Protiviti is a newcomer to the international rankings. The 18 leading international providers in the Lünendonk List generated an estimated 181 billion euros in worldwide revenues in the 2022 financial year. Of this, around 16 billion euros were earned in Germany.

Data analytics and AI changing HR structures

For the current financial year, study participants once again expect double-digit growth, albeit at a slower rate than during the record years of 2021 and 2022. ‘The job-cutting programmes of consultancies such as McKinsey or Accenture are not so much harbingers of a recession, but rather adjustments following significant build-ups of staff,’ says market analyst Hossenfelder. ‘Consultants are also making use of the manifold potential efficiencies of data analytics and artificial intelligence (AI). Especially due to the impact of intelligent assistance systems, consulting firms will in future likely become leaner.’ Bain and PwC, for example, have entered into an alliance with OpenAI, the company behind ChatGPT.

Background to the Lünendonk List

The Lünendonk List of leading business consultancies features the total revenues of international and German consulting providers. For the international service provider category, meaningful description of German consulting revenues is not possible in sufficient detail in order to provide a ranking based solely on these. For this reason, the classic Lünendonk ranking of business consultancies in Germany only includes companies which have their roots and majority capital in Germany. These are listed in order of their total revenues.

The multinational business consulting groups with headquarters or majority shareholdings abroad are listed in a separate overview, Leading International Business Consulting Companies in Germany, which reflects the relevant global consulting revenues and employee figures – insofar as they have generated significant revenues in 2022 (more than €50 million) from business consulting services provided to the German market. Firms featured here include both the major strategy consultancies and full-service providers, as well as specialised consultancies within the human resources (HR) sector. Revenue figures shown for the Big Four audit firms are those generated exclusively from advisory services.

About the Lünendonk Survey

The methodology described above forms the basis for our comprehensive Lünendonk Survey, to be published in July 2023 and available to order now from www.luenendonk.com. For this year’s survey, 71 business consultancies operating in Germany were interviewed between February and May 2023. Lünendonk & Hossenfelder have been conducting this series of surveys annually for over 30 years.

Aktuelles

Lünendonk List 2023: Leading Business Consulting Companies in Germany