The market for Audit, Tax & Advisory

The market for audit, tax & advisory in Germany is characterised by a large number of companies with heterogeneous provider structures. The relevant professional bodies currently represent almost 3,000 audit firms and more than 10,000 tax consulting businesses. Market volumes, comprised significantly of sales in statutory audits and audit-related consulting, amount to around 17 billion euros. Audit providers can be allocated to one of five groups: the Big Four, mid-sized national auditing firms including the Next Seven/Next Ten, mid-sized regional audit firms, small joint practices and international networks/alliances.

Auditing: differentiated service portfolios

Lünendonk has been devoting a dedicated survey to the audit, tax and advisory market since 2006. Over time, the range of services offered by auditing businesses has diversified significantly. Taken together, the greater part of sales continue to be generated from audit and tax consulting, despite a slow but steady weakening of audit sales in relation to the other services. Advisory – comprising services in corporate finance (including M&A), business and IT consulting – is playing an increasingly important role alongside audit and tax, especially among the larger accounting firms. With demand for transformation and consulting on the rise in the face of digitisation, large auditing firms in particular are enhancing their service offerings by adding expertise in digital customer experience, data analytics, AI, cloud, cybersecurity, digital content services or forensics. Legal, accounting, tax reporting and transaction consulting also remain relevant service areas in auditing firm portfolios.

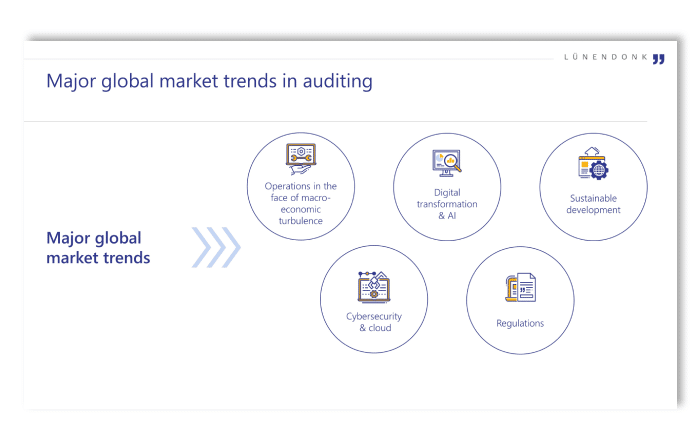

Challenges: digitalisation, ESG, internationalisation, recruitment, regulation

The audit, tax and advisory business is undergoing significant change. Issues such as internationalisation and recruitment have long been on auditors’ agendas. The digital transformation is also shaping and changing business fundamentally. New areas are opening up for business and competition, including around issues of big data and business analytics. At the same time, regulation (regarding rotation, for example) and discussions on audit and consulting separation and joint audit are presenting the industry with new challenges. The new ESG megatrend will also continue to occupy auditing, especially with regard to sustainability and in view of the new legislation.