The market for Business Consulting

With sales of over 38 billion euros and more than 180,000 active consultants, the German market for business consulting is one of the largest in the world. A host of national and international consulting houses operate in Germany, supporting clients on a range of strategic, organisational, process, marketing and HR consulting issues. The market for business consulting is also changing dynamically. Many companies in the field have experienced double-digit annual growth since the financial crisis, with only the Covid-19 pandemic denting the curve. Changing client needs, rapid technological change, societal developments – including with respect to sustainability – as well as uncertainty in the business environment are all stimulating significant client demand for consulting services. And these services will in future be provided via less time spent on site with clients, requiring new soft skills from consultants.

Business consulting: a complex market structure

The provider market in Germany is highly diverse and complex. A large number of small companies operate in the business consulting market alongside the large international consulting houses and medium-sized German firms. Various other service businesses such as IT consultants, system integrators or audit firms are also now entering the consulting market. HR consulting (executive search, interim services) also increasingly features among the new broader range of consulting services offered. It’s clear: the boundaries between business and IT consulting are becoming more and more blurred.

Lünendonk: decades of expertise in the BC market

Lünendonk has been analysing the business consulting market since the mid-1980s, publishing rankings and surveys on the consulting sector for more than 30 years. Today, our analyses cover the whole gamut of provider structures, positioning, relevant technologies and consulting portfolio developments as well as customer demand.

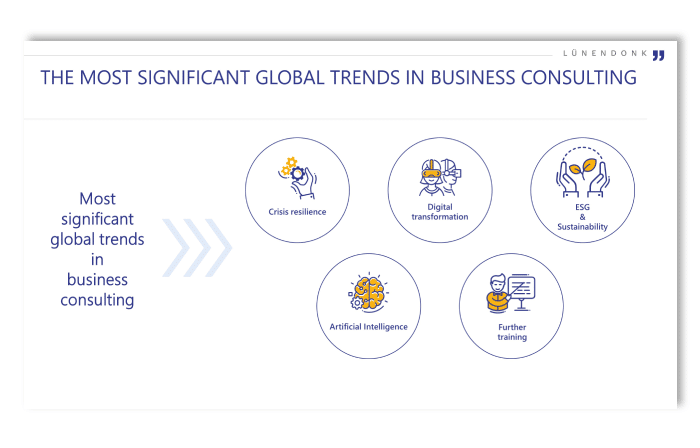

Future demand for consulting driven by digital transformation, automation, personalisation and sustainability

Which megatrends will drive demand for consulting in the future? The growing use of data and corresponding automation, improvement in companies’ agility and responsiveness to the VUCA world around them and greater customer focus can in particular be assumed to ensure demand for business consulting services remains high. Societal challenges and the EU’s ESG taxonomy are increasingly making engagement with sustainability and the circular economy mandatory. Supply chain vulnerability is pushing purchasing and procurement themes onto the agenda. But in a dynamic market, restructuring and reorganisation consulting and turnaround management remain issues as ever, alongside lean management, M&A and transaction advisory, operations management and aftersales and distribution.